In the world of entrepreneurship, establishing a Limited Liability Company (LLC) is often seen as a strategic move to protect personal assets while enjoying the benefits of a flexible business structure. However, many business owners find themselves in a challenging situation where their LLC incurs expenses without generating any income. This scenario can be daunting, but understanding the implications and potential strategies can help you navigate this financial landscape effectively.

Understanding the Financial Implications

When an LLC operates without income, it’s crucial to recognize the financial implications that arise. First and foremost, the absence of revenue can lead to cash flow issues, which may hinder your ability to cover ongoing expenses such as rent, utilities, and salaries. Additionally, continuous losses can impact your LLC's financial health and may raise red flags during tax season.

Tax Considerations

One of the most pressing concerns for LLC owners is how to handle taxes in the absence of income. The IRS allows businesses to deduct ordinary and necessary expenses, even if the business is not generating revenue. This means that you can still claim deductions for expenses such as:

- Startup Costs: If your LLC is in its early stages, you may have incurred startup costs that can be deducted. The IRS allows you to deduct up to $5,000 in the first year, with any remaining costs amortized over 15 years.

- Operating Expenses: Regular expenses such as rent, utilities, and salaries can still be deducted, providing some relief during lean periods.

- Loss Carryforward: If your LLC incurs a net operating loss (NOL), you may be able to carry that loss forward to offset future taxable income, which can be beneficial when your business eventually becomes profitable.

Strategies for Managing Expenses

While it’s essential to understand the implications of having an LLC with no income, it’s equally important to develop strategies to manage expenses effectively. Here are several approaches to consider:

- Budgeting and Financial Planning

Creating a detailed budget can help you identify essential versus non-essential expenses. By prioritizing necessary costs, you can conserve cash flow and ensure that your LLC remains operational during challenging times. Regularly reviewing your budget will also help you make informed decisions about where to cut costs.

- Exploring Alternative Revenue Streams

If your primary business model is not generating income, consider diversifying your offerings. This could involve introducing new products or services, exploring partnerships, or even pivoting to a different market segment. By being adaptable, you can create additional revenue streams that may help offset your expenses.

- Utilizing Grants and Financial Assistance

Many local and federal programs offer grants and financial assistance to small businesses, especially during economic downturns. Research available resources in your area and apply for any programs that align with your business needs. This can provide a much-needed financial cushion while you work towards generating income.

- Networking and Collaboration

Engaging with other entrepreneurs and business owners can open doors to collaboration opportunities. Networking can lead to partnerships that may reduce costs or create new revenue opportunities. Consider joining local business groups or online forums to connect with like-minded individuals.

The Importance of Record-Keeping

Maintaining accurate financial records is crucial for any LLC, especially one facing expenses without income. Detailed records not only help you track your spending but also prepare you for tax season. Ensure that you keep receipts, invoices, and bank statements organized and accessible. This diligence will pay off when it comes time to file taxes or apply for financial assistance.

Conclusion: Embracing the Journey

Operating an LLC without income can be a challenging experience, but it’s essential to remember that many successful businesses have faced similar hurdles. By understanding the financial implications, implementing effective strategies, and maintaining meticulous records, you can navigate this difficult period with resilience.

More Stories

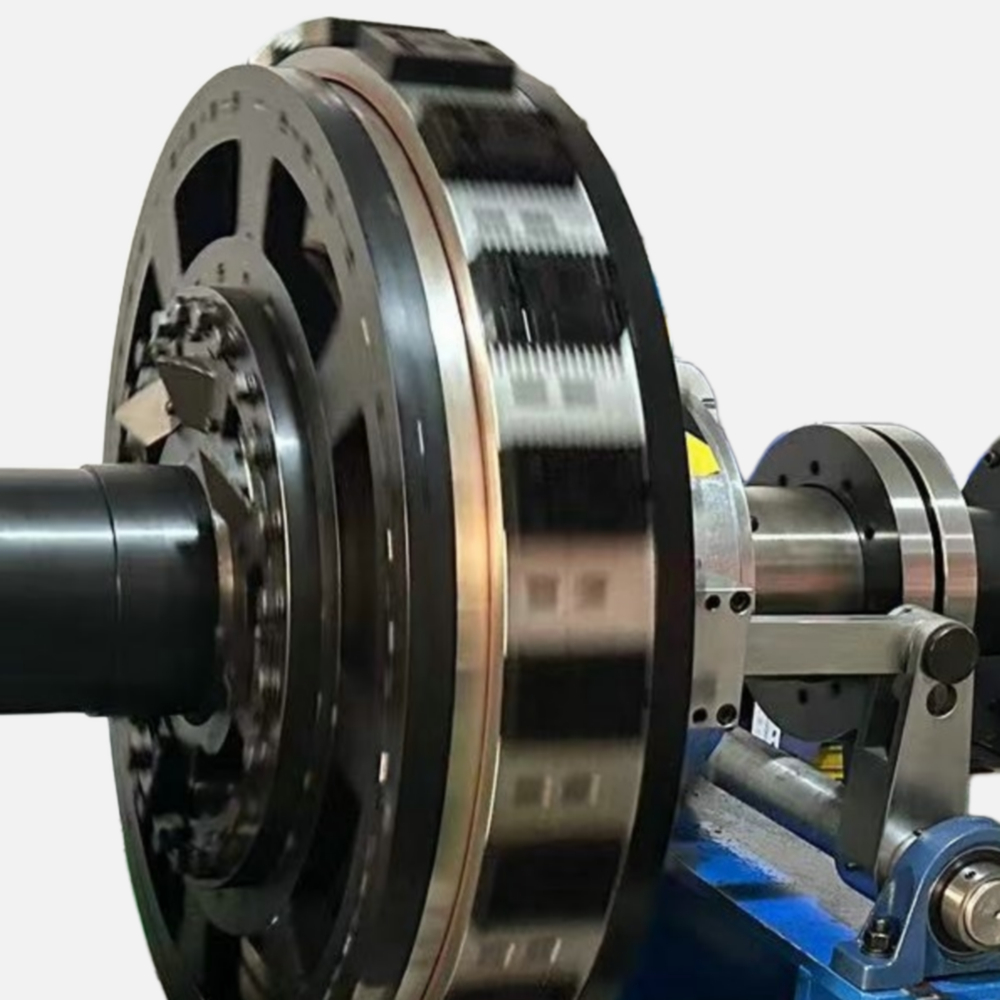

Smart Factory Planning and Lean Layout Synergy

Footwear Inspection: Ensuring Quality and Safety for Men's, Women's, and Children's Shoes

Single-Block Multi-Level Locomotive Factory Design